Let’s face it. Paychecks matter.

Sure, we chase passion but let’s not pretend that rent doesn’t have a say in where we channel our fire.

Payroll department – it’s where the silent heroes of your business live, the cash-flow ninjas, ensuring your employees are paid accurately and on time.

But in today’s ever-evolving business landscape, employee payroll is no longer just about pushing paper and punching numbers. It’s a strategic dance on the tightrope of tax compliance, regulatory changes, and keeping your workforce happy with money in their banks.

Juggling taxes, regulations, and ever-changing employee needs can turn payroll processing into a bureaucratic beast. That’s where investing in the right online payroll system becomes your secret weapon.

In this article, we explore 8 ultimate reasons why businesses must invest in the best online payroll management system.

Accurate Calculations

From miscalculations in employee wages to errors in tax deductions, the fallout of inaccuracies can be costly both in terms of legal, financial, and employee morale.

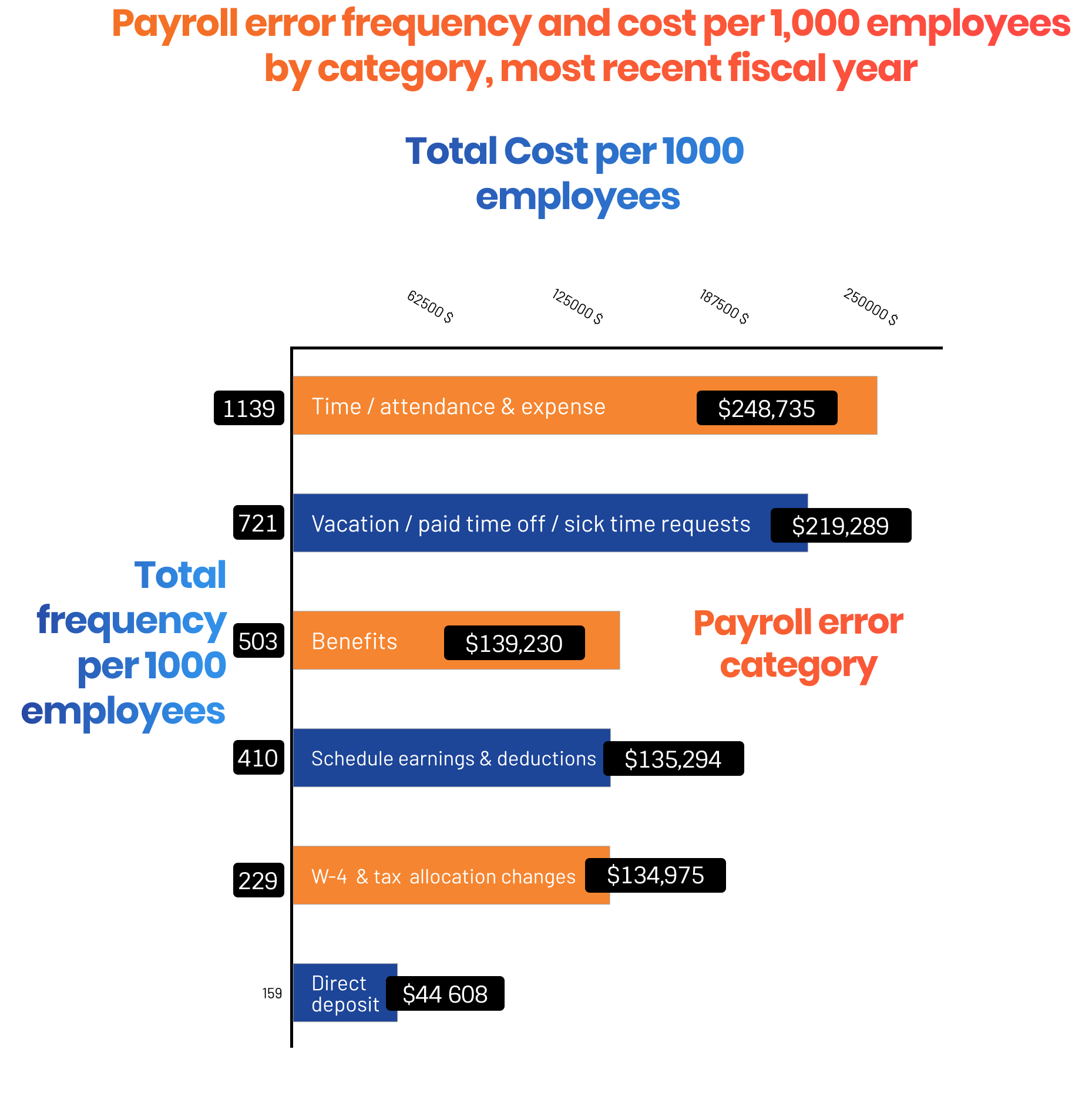

According to a report done in the US, ‘Cost and risks due to payroll errors: Results of the 2022 HR Processing Risk and Cost’1 by Ernst & Young, 1 in 5 payrolls contain miscalculations and inaccuracies; each error costs the company $291 to resolve. The rate of time attendance and expense-related errors account for 1,139 errors per 1000 employees, resulting in a total cost of $248,735 per 1,000 employees.

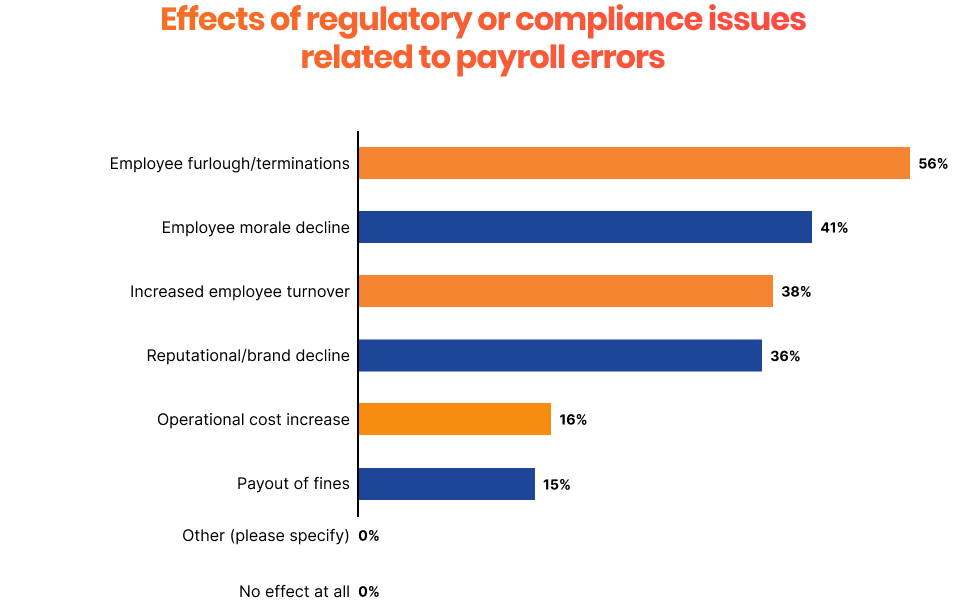

These inaccuracies not only harm the financial health of the company but can further cause regulatory and compliance issues and influence employee terminations (56%), decrease employee morale (41%), and hurt the reputation of the company (36%).

MiHCM’s payroll software, for instance, employs advanced algorithms to ensure accurate calculations of wages, overtime pay, transactions and overall tax deductions, minimising the risk of errors and discrepancies, and ultimately saving your time.

It allows users to set up pay periods, such as daily, weekly, monthly or even yearly and attendance items, such as no. of paydays, pay cut days, overtime days or even double overtime days.

Additionally, you can create transactions, such as allowances and deductions, and assign employees. And when you go to process payments, it will consider the different variables and accurately calculate the right wage for each employee.

MiHCM HR system provides an integrated attendance and payroll management system that captures clock-ins/outs, employee timesheets and overtime hours and feeds that data directly into your salary processing.

Centralised Payroll Processing

Managing employee payrolls for multiple companies can be resource-intensive and may lead to inefficiencies. Moreover, if you’ve been tackling salary calculations manually, you know firsthand the challenges, time commitment, and the potential for errors in this process.

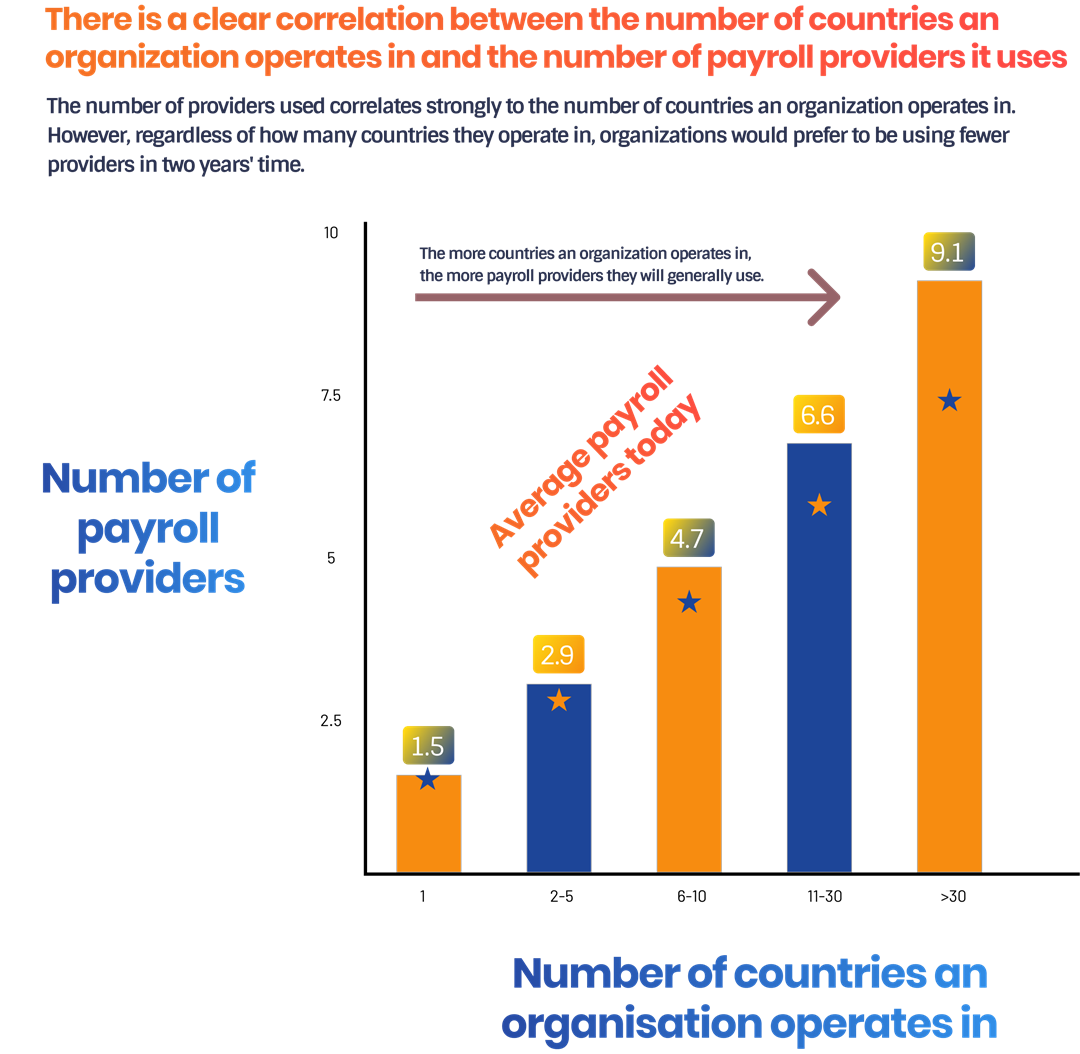

Findings from the 2021 Ernst & Young Global Payroll Report2 identified that the number of countries your business operates in correlates with the number of payroll service providers you will use.

Additionally, companies that employ six or more providers are twice as likely to report challenges in global reporting and data. However, organisations would prefer to reduce this number by half within 2 years.

Having a cloud-based payroll software can help with many of these challenges, such as:

- Reducing reporting challenges

- Simplifying payroll processes

- Automating tasks and calculations

- Optimising your resources by reducing the number of online payroll providers

- Reducing the risk of errors

- Ensuring consistency and cost savings

- Improving overall payroll efficiency

Localised & Country-Specific Compliances

Operating in different countries means navigating diverse tax codes, labour laws, and statutory requirements. Payroll software that aligns with these specific legal frameworks ensures that your organisation remains in strict adherence to local laws no matter how many companies you have around the globe.

This not only safeguards your business from legal complications but also fosters a culture of trust and transparency with your workforce.

Let’s say your headquarters is in Singapore, but you have global offices in Malaysia, the Philippines, Hong Kong, and the United Arab Emirates (UAE).

Understanding each country’s complex statutory requirements can overwhelm anyone. With a single payroll management system and the expert knowledge of payroll software providers that come with it, you can confidently process your payroll in less time than ever.

A single payroll system can help you streamline your payroll across businesses in different countries, providing a higher level of visibility across your businesses.

Adherence to Evolving Compliances with Statutory Reports

According to the 2021 EY Global Payroll Survey2, 30% of the 181 global organisations surveyed identified keeping pace with regulatory changes as one of the top 2 compliance challenges in payroll.

The problem is that mediocre software often falls short, exposing businesses to compliance risks that can result in penalties and legal repercussions.

MiHCM Payroll software is designed to be agile in the face of regulatory changes with regular updates to ensure businesses remain compliant with the latest labour laws and tax regulations.

This module comes with a payroll formula builder and a report base; it consists of statutory reports per the country where your business operates.

If you are operating a business in Malaysia, MiHCM will ensure that all employer and employee contributions are made according to Malaysian tax regulations.

This means making sure that EPF, SOSCO, PCB and EIS are deducted from the monthly remuneration accordingly.

Automated Workflows & Faster Processing

Payroll processing shouldn’t reduce anyone into a series of fits due to the daunting long workflow of calculating, payroll accounting and sorting monthly salaries.

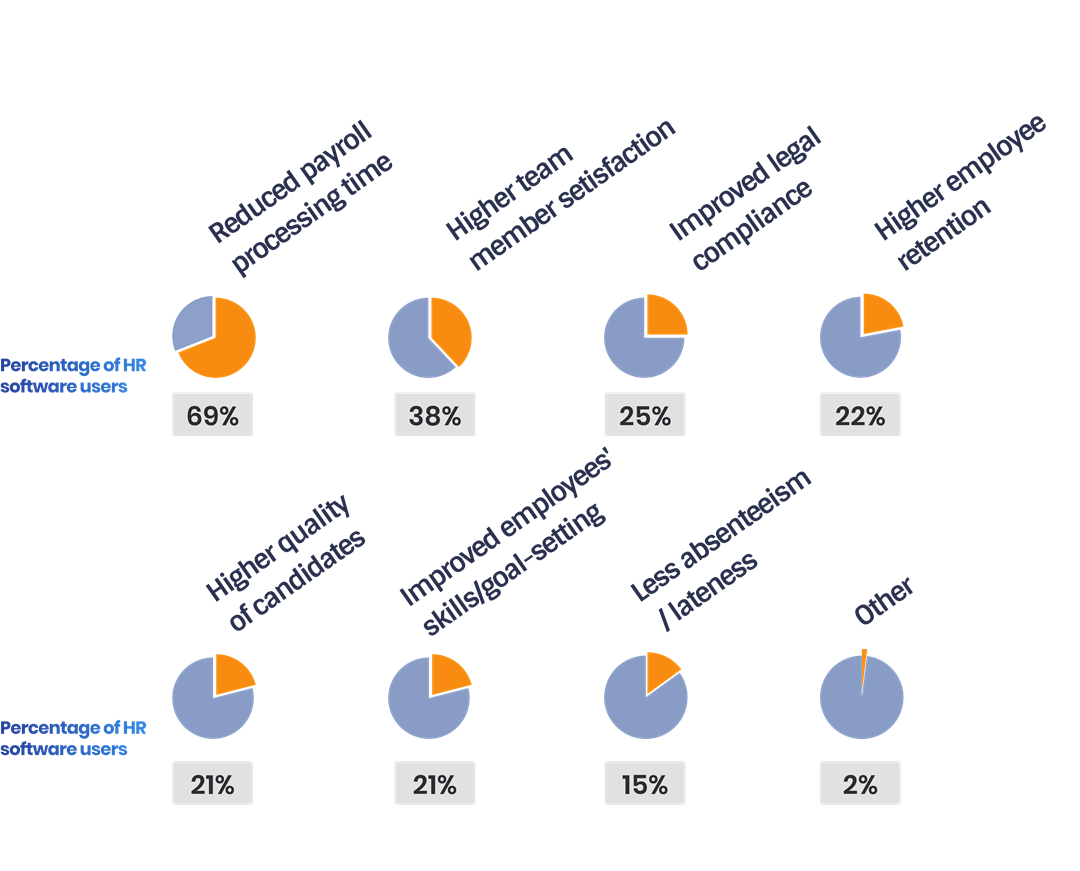

The 2023 HR Management Systems Market Report for Small Businesses3 noted that 69% of users found that using cloud-based HR software helped drastically reduce salary processing time.

MiHCM Payroll system for small, medium, and large businesses streamlines your workflows through automation, reducing manual intervention and the likelihood of errors, resulting in swift and accurate payroll processing.

Did you know that MiHCM can process payroll for 10,000 employees within 20 minutes or less? The system is designed to ensure that salaries are processed faster, easily and done across multiple companies on its assigned day.

MiHCM further allows you to create different transactions, build formula groups, assign employees, and engage in automated processing with minimal interventions.

You can also set up loan details and be guaranteed that employee salaries will be processed with the right deduction until they are settled.

Simplified Features with Checklists

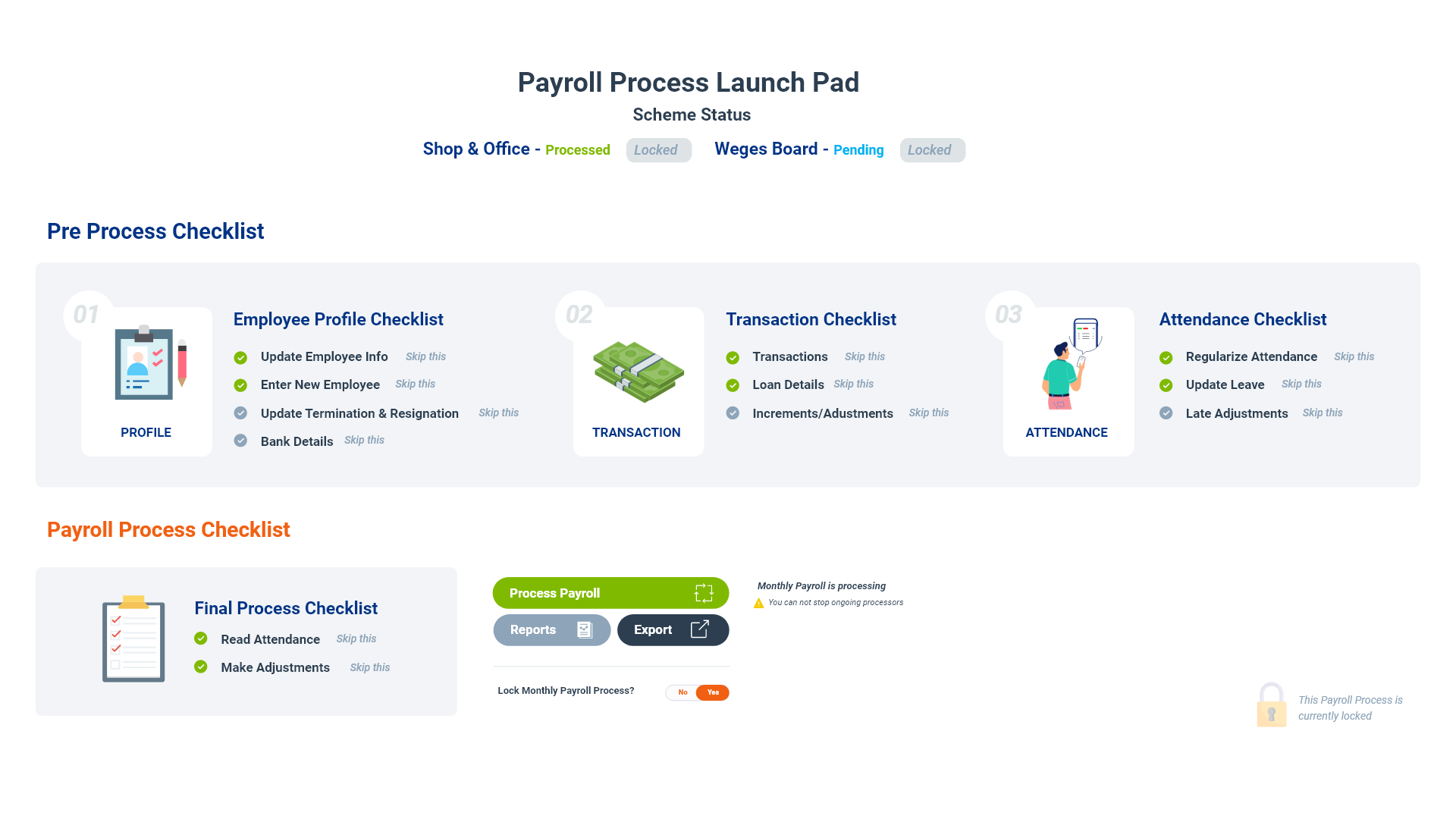

While we understand the complexities behind salary processing, MiHCM provides you with an easier and simpler way to process payroll and send electronic payslips to employees.

MiHCM features a user-friendly interface that simplifies the payroll management journey for users at every level of expertise.

The Monthly Tasks feature helps you carry out routine payroll work from processing transactions to managing attendance-related payroll items, viewing the loan flow and details to finally processing payments.

This journey can be overwhelming for anyone, especially when managing finances and substantial transactions.

Sometimes, you may overlook certain tasks, particularly those that aren’t part of the routine, such as keeping tabs on employee loan deductions, salary adjustments, or even resignations.

Our Launch Pad provides you with a series of checklists, such as:

- Employee Profile Checklist reminds you to add new employees, ensure employee general information and bank details are updated and remind you to check on terminating or resigning employees.

- Transaction Checklist reminds you to check on transactions, loan details and any increments or adjustments.

- Attendance Checklist reminds you to check on employee time and attendance and update leave.

- Final Process Checklist reminds you to ensure that attendance has been finalised and that any adjustments are made before salaries are processed.

Once you process payroll, you can easily download and upload the payroll remittance file to any bank. MiHCM eliminates the use of paper payslips and automatically sends the salary slip to the mobile and web app.

Comprehensive Payroll Reports

Visibility into payroll-related data is crucial for informed decision-making. MiHCM comprehensive reports on payroll, leave and attendance from expenses, and leave allocation summary to daily absenteeism, absent without leave and daily overtime reports.

These reports provide you with a higher level of understanding of expenses through different compartments that come together. Using Payroll Reports, you can view the necessary details to see the overall monthly contributions.

Secured Data & High Scalability

Maintaining data security and compliance with data protection regulations is paramount in payroll administration.

Multi-company payroll software often includes robust security measures to protect sensitive employee information. It also helps organisations adhere to data privacy laws across various jurisdictions, mitigating the risk of legal consequences.

MiHCM is powered on the Microsoft Azure Cloud infrastructure and comes with a highly secure and stable cloud foundation with encryption mechanisms, identity access and authentication and multi-layered, rigorous security checks, controls, and tools that ensure that your data is secure all the time.

The infrastructure is designed with scalability in mind, allowing your processes to evolve seamlessly with the growth of your organisation.

Whether you’re adding new employees, expanding into new markets, or opening a company in another continent, your payroll software should be a flexible companion on your journey.

The Best Payroll Software goes to…

Invest in the financial health and sustainability of your business. MiHCM stands out as a beacon of excellence, offering a comprehensive solution that not only meets but exceeds the payroll expectations of modern businesses.

In the realm of payroll processing, don’t settle for the ordinary—opt for the extraordinary with MiHCM. Your payroll deserves nothing less than the best.

- Cost and Risks Due to Payrlil Errors: Results of the 2022 HR Processing Risk and Cost Survey:

- 2021 EY Global Payrlil Survey | How can payrlil drive value in organisations with flexibility?

- 2023 HR Management Systems Market Report for Small Businesses

- Azure Security