Global payroll solutions are transformative tools designed to manage the payroll needs of multinational companies efficiently.

These solutions centralise payroll processes across various countries, enabling companies to handle international payroll operations in a streamlined manner. They merge financial, regulatory, and workforce data, simplifying the complexities associated with traditional global payroll management.

Challenges in global payroll management

Multinational companies often grapple with diverse payroll challenges, primarily due to varying labour laws, currency differences, and language barriers. Global payroll solutions address these challenges by providing a unified platform that ensures compliance, reduces errors, and enhances payroll accuracy.

This is crucial for businesses that aim to expand their operations internationally without the headache of navigating complex payroll landscapes unique to each country.

Challenges in global payroll management typically include maintaining compliance with different national regulations, managing multiple currencies, and ensuring accurate tax reporting. These complexities can result in increased operational costs and the risk of financial penalties if not managed correctly.

As such, global payroll solutions are invaluable in helping organisations minimise these risks, providing a consistent and error-free payroll process that aligns with the company’s financial and operational strategies.

Global payroll solutions are invaluable for businesses aiming to streamline payroll complexities across diverse international landscapes. With automated payroll calculations and processing, these systems significantly reduce manual errors and save time, ensuring that payments are timely and accurate.

The integration of these solutions with existing HR systems allows for seamless operations, reducing the burden of multiple data entries and the chances of inconsistencies.

Key features

One of the standout features of a global payroll solution is its ability to comply with complex international labour laws and regulations. Given the differences in employment laws across countries, staying compliant is challenging.

Global payroll systems handle these variations by updating automatically to reflect changes in regulations, ensuring that businesses remain compliant without manual intervention.

Key features include:

- Automated payroll processing: By automating payroll processes, global payroll solutions minimise human error and increase efficiency, allowing businesses to focus on strategic objectives rather than administrative tasks.

- Compliance management: Built-in compliance with country-specific labour laws helps businesses manage regulations effectively, reducing compliance risks.

- Multi-currency and multi-language support: These systems facilitate transactions in multiple currencies and languages, making them adaptable to various international markets.

- Integration with HR systems: Seamless integration enhances operational efficiency by consolidating data, which leads to improved decision-making and reporting capabilities.

By utilising these features, businesses can effectively manage the intricacies of a global workforce.

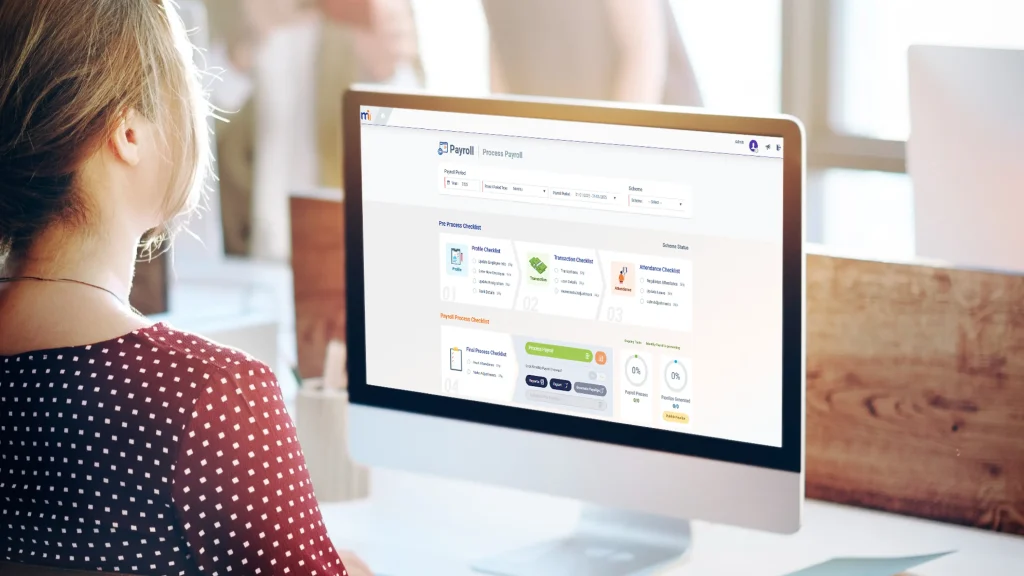

Choosing the right platform, such as MiHCM’s global payroll solutions, can provide the tools necessary to handle multi-currency payroll across multiple countries, ensuring that your HR operations remain efficient and compliant. These solutions not only simplify the payroll management process but also empower HR teams to enhance workforce productivity through strategic data insights.

When managing global payroll operations, understanding the compliance and regulatory considerations is paramount. Differing labour laws, intricate tax regulations, and various statutory requirements across countries can pose significant challenges for multinational organisations. Utilising comprehensive global payroll services ensures that you meet these compliance demands efficiently.

Each country has its unique set of regulations, making it a daunting task for payroll administrators to keep up with ever-evolving labour laws. Adopting global payroll solutions can provide immediate updates on regulatory changes, thereby automating compliance processes and reducing potential legal risks.

A key feature of global payroll management solutions is their ability to provide seamless integration with existing HR and financial systems. This integration streamlines operations and ensures that you have access to unified data reflecting compliant practices across all regions of operation.

Compliance strategies

Here are some strategies global payroll solutions offer to maintain compliance:

- Automated updates: An intelligent global payroll software automatically updates its system to reflect new legislation and tax changes.

- Regulatory alerts: Receive alerts and notifications about upcoming regulatory changes that might impact your business operations.

- Audit trails: Create detailed audit trails that document compliance activities and assist during regulatory inspections or audits.

For businesses aiming to optimise international payroll processing, employing the best international payroll software like MiHCM’s global payroll solution can aid in effective compliance management.

By leveraging such solutions, you not only streamline payroll processing but also enhance control over compliance, ensuring that your global payroll operations align with local laws and regulations.

Improve efficiency effortlessly

Integrating global payroll solutions provides numerous benefits that significantly improve the efficiency of payroll management across different regions. By consolidating payroll operations, companies can simplify the complexities of managing a diverse workforce, ensuring uniformity and compliance while reducing administrative burdens.

One of the major advantages is the improved accuracy and speed of payroll processing. These solutions leverage automation to eliminate manual errors, which are particularly prevalent in international payroll management. As a result, organisations can experience consistent timeliness and precision in processing payrolls, irrespective of geographical boundaries.

The unified data provided by global payroll solutions allows for better financial control and enhances decision-making capabilities. By harmonising payroll data from various regions, businesses gain valuable insights into their financial performance and workforce dynamics, leading to more informed strategic decisions.

Benefits include:

- Streamlined payroll management: Centralising operations results in reduced discrepancies and a more cohesive approach to managing international payroll challenges.

- Compliance enhancement: Ensures adherence to local labour laws, reducing compliance risks and potential penalties.

- Optimised workforce productivity: By utilising integrated solutions like MiHCM’s global payroll services, HR teams can focus on strategic tasks rather than routine payroll processing.

How to select a global payroll provider

In the search for a reliable global payroll provider, it’s essential to evaluate the options based on key criteria. Selecting a provider that aligns with your company’s needs can significantly impact your international operations and compliance success.

1. Comprehensive features: Look for a provider offering automated payroll calculations, compliance with international labour laws, and seamless integration with HR systems. For example, MiHCM stands out with its ability to support multi-currency transactions and adapt to various regulatory frameworks.

2. Pricing and value: Compare providers based on their cost-effectiveness. Understanding the pricing models – such as subscription-based or per-employee pricing – can help determine your overall return on investment. Ensure that the chosen provider delivers robust features that justify the price.

3. Scalability: Evaluate whether the provider can scale with your business as it grows. MiHCM offers solutions designed for both small teams and large enterprises, ensuring flexibility as your organisational needs evolve.

4. Customer support: Opt for a provider known for exceptional customer service and support. Effective support ensures that any issues you encounter are resolved quickly, minimising disruptions to your operations.

A decision matrix or comparison table might be helpful to visualise how each provider meets these criteria. This approach allows HR managers and business owners to make informed decisions that align with their strategic goals, ensuring that the chosen solution seamlessly integrates into existing systems and processes.

Explore best practices for international payroll processing for additional guidance on optimising your global payroll approach.

Remember, the right global payroll provider can drive efficiency and compliance, ultimately enhancing your company’s international success.

MiHCM’s global payroll solutions are robust offerings designed to meet the payroll needs of businesses operating in multiple countries. With a focus on providing seamless, efficient payroll management, MiHCM offers solutions like MiHCM Enterprise and MiHCM Lite to cater to both large enterprises and smaller teams.

Companies managing a global workforce often face unique challenges, from complying with differing country-specific labour laws to handling multi-currency transactions.

MiHCM addresses these issues with comprehensive tools that facilitate managing payroll across diverse regulatory landscapes. This system’s integration capabilities streamline operations by ensuring that payroll processing and HR systems work in tandem, reducing duplication and improving efficiency.

- Automated calculations: MiHCM’s payroll software automates essential payroll functions, ensuring accuracy and efficiency in calculations and processing. Its ability to handle multi-currency payments is crucial for businesses with employees spread globally.

- Compliance with labour laws: MiHCM keeps you updated with the latest labour regulations, automating compliance and minimising legal risks. This feature is especially critical as regulatory environments continually evolve.

- Powerful HR analytics: The inclusion of tools like MiHCM Data & AI empowers businesses to leverage data insights for strategic decision-making, improving workforce productivity and operational efficiency.

In practical terms, MiHCM offers businesses a unified platform where they can oversee payroll management efficiently, irrespective of their location. The offerings extend beyond mere payroll processing, adding value with its AI-driven HR analytics that unlock insights into employee performance and engagement, thereby empowering HR teams.

Across various implementations, MiHCM has helped numerous organisations streamline payroll operations, mitigate compliance risks, and enhance decision-making capabilities. For instance, businesses have reported significant reductions in payroll discrepancies and increased satisfaction among their payroll administrators post-MiHCM implementation.

With MiHCM’s services, you can expect a comprehensive solution tailored to meet the demanding requirements of global payroll management, backed by a system that evolves with your business. Explore more about how MiHCM can transform your global payroll processes on the website.

Upon adoption of MiHCM’s solution, corporations experience a significant transformation:

- Centralised payroll operations: With MiHCM, companies can integrate their payroll processes into a single, unified platform, accessible from anywhere. This change is pivotal in providing a transparent view of all payroll activities globally.

- Enhanced compliance: Regular updates keep companies informed of and compliant with international labour regulations. The automated compliance checks eliminate the risk of manual mistakes, effectively securing companies against potential legal issues.

- Reduction in processing time: Automating payroll processes means a quicker turnaround with payroll cycles being completed significantly faster than before, enhancing overall operational efficiency.

Post-implementation, companies report a significant decrease in payroll discrepancies, leading to a noticeable increase in employee satisfaction among their payroll administrators.

Beyond streamlining international payroll operations, they also appreciate the insights offered by MiHCM’s HR analytics, which aid in strategic decision-making regarding workforce management.

Leveraging solutions like MiHCM can resolve existing operational headaches and unlock new capabilities in global payroll services.

Trends shaping the future of global payroll

The landscape of global payroll solutions is evolving rapidly, driven by emerging trends and technological innovations that promise to further streamline international payroll operations.

As companies increasingly operate across borders, the demand for innovative solutions that cater to complex payroll requirements is growing. Let’s explore the trends shaping the future of global payroll.

1. Integration of AI and automation: AI-powered technologies are revolutionising payroll management by automating repetitive tasks, reducing errors, and freeing up HR resources for strategic activities. By transforming traditional payroll into a dynamic function, AI solutions like MiHCM Data & AI not only enhance efficiency but also provide insightful analytics that drive informed decision-making.

2. Enhanced compliance features: With regulations continuously shifting, advanced global payroll solutions are incorporating real-time compliance updates, ensuring that businesses can adapt quickly to new laws. This focus on compliance not only mitigates risks but also provides peace of mind for multinational corporations managing varied labour laws.

3. Emphasis on employee experience: The future of payroll is also about enhancing the employee experience. By integrating multi-currency and multi-language support, solutions like MiHCM create a seamless experience for a global workforce, improving engagement and satisfaction.

As these innovations continue to transform payroll systems, MiHCM remains at the forefront, committed to adapting and leading in the evolving realm of global payroll. For organisations seeking to optimise their international payroll operations, staying informed about these trends can be pivotal in maintaining a competitive edge.